Check your Summary of Benefits and Coverage (SBC) document. This details your plan’s specifics, including copays, deductibles, and coinsurance. Compare your prescription’s cost with your plan’s formulary – this list shows covered medications and their associated costs.

Understanding Your Deductible

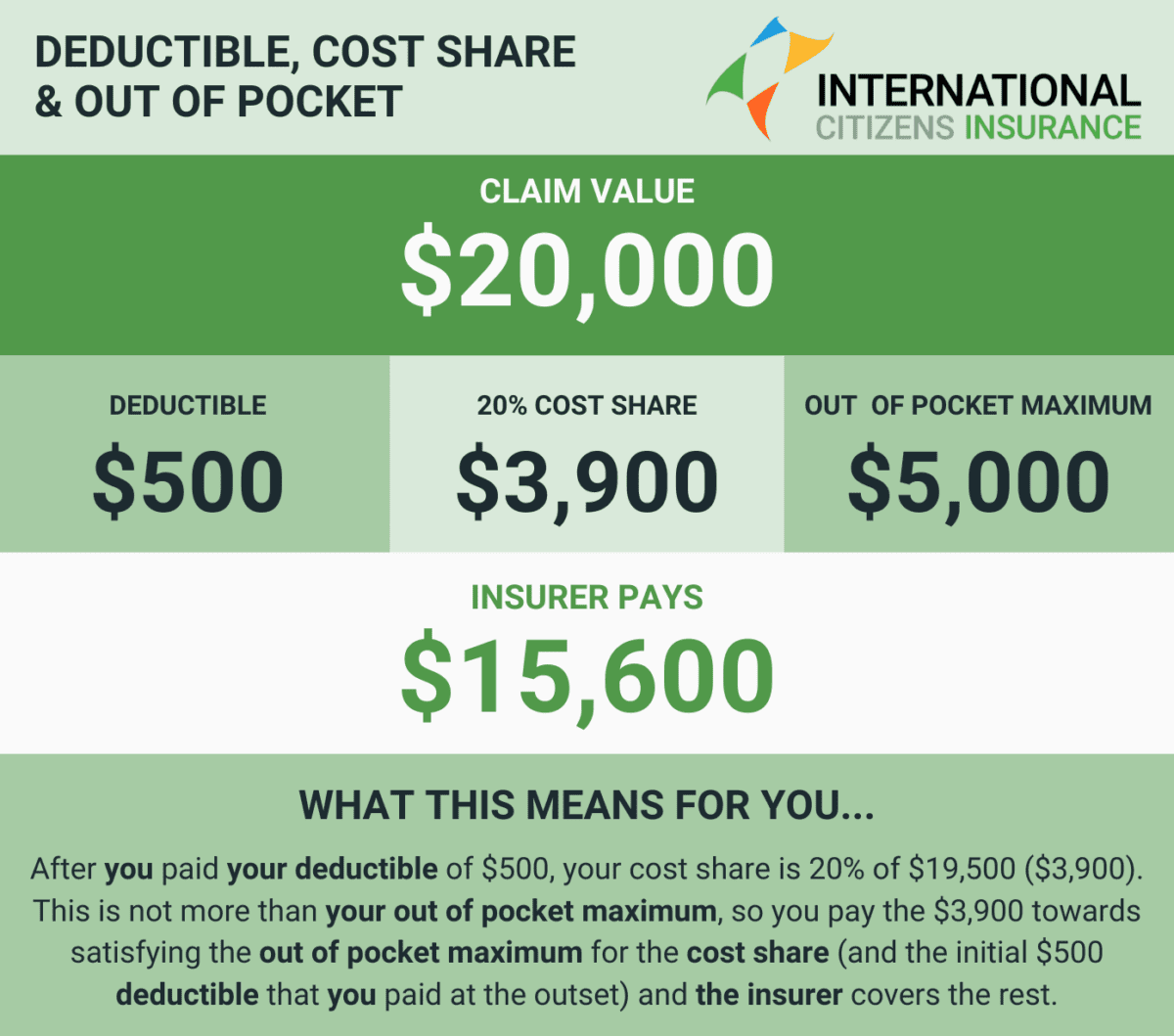

Your deductible is the amount you pay before your insurance covers costs. Reach your deductible first for the best cost savings on subsequent prescriptions. If your deductible is high, consider a prescription savings card to reduce your out-of-pocket expenses.

Copays, Coinsurance, and Maximum Out-of-Pocket

After meeting your deductible, you’ll usually pay a copay (a fixed fee) or coinsurance (a percentage of the cost). Your plan will specify which applies. Your maximum out-of-pocket expense represents the most you’ll pay annually. Once you reach this limit, your insurance covers 100% of covered medications.

Contact your insurance provider directly with questions about specific medications and costs. They can clarify your coverage and offer the most accurate pricing information.